Politics on the Road to the U. S. Monetary Union

Peter L. Rousseau (peter.l.rousseau@vanderbilt.edu), Vanderbilt University

URL: http://econpapers.repec.org/paper/vanwpaper/vuecon-sub-13-00006.htm

Abstract: Is political unity a necessary condition for a successful monetary union? The early United States seems a leading example of this principle. But the view is misleadingly simple. I review the historical record and uncover signs that the United States did not achieve a stable monetary union, at least if measured by a uniform currency and adequate safeguards against systemic risk, until well after the Civil War and probably not until the founding of the Federal Reserve. Political change and shifting policy positions end up as key factors in shaping the monetary union that did ultimately emerge.

Review by Manuel Bautista Gonzalez

In this piece published in NEP-HIS 2013-04-13, Peter Rousseau argues for the need to complicate the widely-held, simplistic view that political union is a necessary condition for a successful monetary union. By studying the intersection of politics, money and finance in the United States from the American Revolution to the Great Depression, Rousseau posits that there is no automatic mechanism to ensure the concurrence of political and monetary union.

Although Rousseau begins his paper with a rather narrow definition of monetary union as a “system with a uniform currency and adequate safeguards against systemic risk” (Rousseau 2013: 1), he expands it throughout the paper to take into account other characteristics and consequences of processes of monetary unification.

The most obvious element of monetary union is the adoption of a single unit of account and uniform currency throughout a territory. To function, monetary union requires credible authorities with effective powers to control the supply of money while properly backing liabilities to minimize uncertainty. To reduce transactions costs, monetary union also demands institutional arrangements between the government and the banking system as a private supplier of means of payment. With monetary union, short-term and long-term capital markets become part of a payments system, whereby due to network effects, the reduction of borrowing costs in regular conditions can meet rapidly-spreading liquidity squeezes in times of financial distress. To recapitulate, monetary union has a dual, difficult nature, for it requires the virtuous alignment of public and private interests; henceforth, politics will mold for better or for worse the actual operation of any monetary union.

Politics, Money and Finance in America from the Revolution to the Great Depression

Currency shortage seriously affected the English colonies in America: as foreign trade drained most of the specie in circulation, colonists had to rely extensively on bookkeeping credit, the use of export staples as money, and foreign money such as the Spanish American silver dollar to conduct transactions. Colonial legislatures experimented with the issuing of “bills of credit”, instruments that were intended to remedy monetary scarcity and circulated as they were accepted in the payment of taxes. Inconsistent monetary policies arose as there was no binding commitment to control the collective supply of money. Each colony issued different levels of bills of credit, creating divergences in the value of colonial paper monies vis-à-vis the sterling pound. The Currency Act of 1751, protected British interests while further increasing monetary scarcity in the colonies, as the Act ruled out the use of paper money.

The American Revolution brought the need to fund the war effort against Great Britain. Lacking an explicit mandate to raise taxes, colonial representatives in the Continental Congress authorized the issuing of paper money. The so-called continentals were redeemable notes in silver dollars; however, the notes did not fully explain the conditions under which conversion from paper to specie would take place. Soon, as Congress authorized further emissions, the value of the continentals plummeted. The inflationary issuing of continentals paid almost 40% of the total military expenditure during the American fight for independence (Rousseau 2013: 9).

Although facilitated by “common culture and language”, the nascent political union did not count with a central monetary authority (Rousseau 2013: 1). The Articles of Confederation, ratified by 1781, granted to the states the right to print paper money. Some states were very prudent and successful with their notes, while others were very profligate, resulting in their paper money depreciating rapidly. The state of affairs echoed the monetary situation during colonial rule and the Revolution, and so the money question was an important preoccupation in the minds of the statesmen discussing a political framework for the developing nation.

At the time, two competing schools of political economy emerged (McCoy, 1980). On the one hand, centralizing Federalists, led by Alexander Hamilton, stood for a strong national government with a quasi-central bank, as they saw it fit for the United States to fight and finance its way in an Atlantic economy dominated by the European empires. On the other hand, decentralizing Republicans, coalescing around Thomas Jefferson and James Madison, supported less federal oversight of monetary matters and advocated for states’ rights, as they held the view of a republic of propertied farmers exporting their agricultural surpluses. Although Madison and Jefferson promoted “social and economic development across space”, whereas Hamilton stood for intensive development “through time”, their shared concerns over the success of the American national project guaranteed the adoption of the Constitution in 1789. (McCoy 1980: 136).

Rousseau argues that the tension between centralizing and decentralizing positions shaped monetary and financial institutions and practices in the United States during the long nineteenth century. With the enactment of the Constitution, a national government with the power to tax and fund its own expenditures came into existence. At first, the Federalist vision on money and finance prevailed. Given the cautionary experience of the Confederation period, American statesmen agreed to assert federal dominance over monetary matters, by granting Congress the exclusive power to coin currency.

Soon after, the first secretary of the Treasury, Alexander Hamilton, enacted a series of financial and monetary reforms, establishing the dollar as unit of account, creating the US mint and the first Bank of the United States. Hamilton also reasoned that the public debts incurred during the American Revolution required a permanent solution as a precondition for the development of financial markets. In the end, the government repudiated the continentals and stood in favor of the debt-restructuring of medium- and long-term liabilities. The United States, then, “forged a monetary union in the wake of repudiation” (Rousseau 2013: 11).

Founded in 1791 and based in Philadelphia, the first Bank of the United States dealt successfully with the 1792 financial crisis by injecting liquidity into the New York market. The Constitution did not preclude states from chartering banks, so in the following years, local legislatures granted charters to open state banks, which issued their own notes. As a result of political pressure, the first Bank opened branches in several cities across the nation. However, local bankers and elites thought the Bank was a constraining entity against their wishes to expand the money supply and credit, as the Bank accumulated and presented for redemption the notes of those state banks deemed too lax.

By 1800, the US monetary system was “anarchic and unstable”, as the monetary supply was composed of foreign and domestic gold and silver coins and bars, paper monies, bookkeeping credit and commodity monies such as tobacco, iron nails, animal pelts and wampum (Mihm 2007: 32). Republican opposition to the first Bank gained momentum, and thus the bank failed to renew its charter in 1811. The pressing financial needs during the War of 1812 against Great Britain created the necessary consensus for the convenience of a national bank, an entity able to centralize resources and decision-making in dire times. Thus, the second Bank of the United States was chartered in 1816. After Nicholas Biddle became its director in 1823, the second Bank was the preeminent entity ruling over the American monetary and financial systems. As its predecessor, the second Bank prevented state banks from lending in excess by frequently redeeming their notes in exchange of specie reserves.

When President Andrew Jackson arrived to power in 1829, he voiced the distaste and distrust of many against the second Bank of the United States. As true heir of the Jeffersonian Republican tradition, Jackson could not stand the existence of a powerful institution limiting money creation in the developing regions of the Middle West and the Deep South. The so-called Bank Wars describing the animosity between the Jackson administration and Nicholas Biddle ended when Jackson vetoed the renewal of the second Bank’s charter in 1832. To explain Jackson’s actions, which have usually been vilified in the literature, Rousseau advances the hypothesis that Jackson’s ultimate goal was to better redistribute banking services from the East to the West and South, and expand financial coverage across the territory. Yet, it cannot be denied that Jackson’s tenure ended with the worst economic downturn since the 1790s, as the crash of 1837 was the prelude of a depression that would last well until 1843.

US antebellum banking after the Second Bank is usually identified with the geographic and numeric expansion of banking and the rise of free banks across the country. As newer, local groups pushed for the creation of banks to fund their own ventures, state legislatures passed legislation allowing any interested party to freely create a bank, as long as the institution met certain minimum capital requirements. The diminution of barriers of entry increased the number of banks in a nation avidly expanding to the West. By 1849, the discovery of gold in the newly-annexed California eased the constraint of limited metallic reserves affecting the American economy, and by 1857, the country was able to remove legal tender status to foreign money.

Countless, different paper monies in circulation were the direct consequence of an increase in the number of banks. Although all banknotes were denominated in the same unit of account (the dollar), the value of paper monies was not uniform across space and time. The farther a banknote circulated, the more difficult it was to know whether the issuing bank had sufficient reserves to ensure its redemption. Counterfeiters introduced false notes in trade circuits with relative success, whereas wildcat banks circulated notes too without having any reserves circulated notes too (Mihm 2007). Thus, most banknotes were not accepted at face value and circulated with discounts, in a very interesting example of how private actors attempted to satisfy their liquidity demands in the absence of a monetary authority with monopoly of issue. In any case, this multifaceted monetary system without a central bank did not prevent the convergence of borrowing costs across the nation as soon as 1845 (Rousseau 2013: 17).

The military escalation of the unsolvable sectional conflict over slavery provided a defining moment for the American monetary and financial systems. During the Civil War, the national government reined in the monetary affairs of the Union. Convertibility of the dollar to gold was suspended, followed by the creation of national banks, the floating of public debt, and the issuing of demand notes known as greenbacks and legal tender notes. As the greenbacks were not redeemable in gold, they soon experimented depreciation, but the credibility of the Union authorities maintained their value “at a rate reasonably close to par” (Rousseau 2013: 24). National banks had high capital requirements and were required to hold federal securities as collateral. The newly created Office of the Comptroller of the Currency oversaw both state and national banks, making it compulsory for them to keep federal bonds as collateral, providing in exchange the notes they would use in their daily business. For the first time, then, currency was uniform, as banknotes only differed in the name of the bank in which they could be redeemed.

After the Union won the war in 1865, the resumption question (i. e., the return to the gold standard) and the conversion of greenbacks to gold dominated most monetary policy debates. In the postbellum era, national banks coexisted with a decreasing number of state banks, which found it even more difficult to operate after a 10% tax on their notes was enacted in 1866. The monetary supply grew with a slower pace, which resulted in deflationary pressures and economic stagnation, allowing the American economy to accumulate sufficient gold with which convertibility could be finally restored, as it happened in 1879. With this, the unification of the currency with its backing finally happened, as paper money and gold began trading at par.

The Gold Standard Act in 1900 diminished the capital requirements to establish a national bank, leading to the creation of more national banks which made up for the lost state banks. The US financial system increased in size and in number of banks, yet, the architecture of the financial network made it prone to diffuse financial shocks and liquidity crises with quick and devastating effects. When these happened, as in 1873, 1884, 1890, 1893 and 1907, the bigger banks had to work out private solutions in the form of clearinghouses, which provided liquidity to the affected but otherwise solvent banks in the system.

The 1907 crisis spurred numerous debates and ultimately generated institutional reforms, as the panic made obvious that the US financial system required a lender of last resort. In 1913 the Federal Reserve Act was passed, allowing the creation of a national agency overseeing monetary matters and responding to systemic risks. The Fed was a compromise solution “of Federalist [or centralizing] and Democratic [or decentralizing] leanings” in the United States (Rousseau 2013: 26). The Federal Reserve system was conceived as a collection of regional reserve banks where local actors were represented, and a Board which reunited the interests of these affiliated banks for managing the monetary and financial systems on a national scale.

Nonetheless, the Federal Reserve’s response to the Great Depression was rather disappointing, as monetary contraction deepened the economic downturn. Rousseau asserts that this had less to do with the architecture of the system as with authorities’ “misunderstanding” of how monetary policy tools could be used to counteract the depression (Rousseau 2013: 27). Yet, one can wonder whether this misunderstanding had more to do with the consensus surrounding the near-sanctity of the gold standard, a basic tenet of policymakers then (Eichengreen 1992, Temin 1976). Be it as it may, the 1930s saw a shift in the balance of monetary power, as decision-making moved away from the regional banks to the central Board of Governors in Washington.

A Note on Comparing the Historical Processes of Monetary Unification in the United States and the European Union

In this cautionary tale, Rousseau finds certain lessons for worried European policymakers. “If history offers insights for the future, perhaps monetary stability in the EU will also arise through a sequence of informed trial and error across political and monetary actors, though knowledge of the past may accelerate the time frame this time around” (Rousseau 2013: 1). The contemporary US financial system “was not the result of a “big bang,” but rather derives from a fluid, ever-evolving, and organic process of improvement, misstep and improvement driven by interactions between political and monetary forces” (Rousseau 2013: 27).

In my opinion, a following comparative exercise in monetary and financial history between the United States and Europe would need to control for the level of development, economic structure, and regional specialization across the constituent parts of the monetary union in question. Think of the colonial division of labor between the economically-diversified Northeast and Mid-Atlantic and the export economy of the Chesapeake and the Upper South. Latter on, as time progressed, the analysis would need to include the agricultural orientation of the Middle West, the mining and natural resources exploitation of the West, as well as the slave economies of the cotton kingdom in the Deep South. Only then could this historical narrative serve to account for the differences between the countries of Southern Europe (think Spain, Portugal, Italy, Greece) compared to the more developed and diversified economies of Germany and France.

Then, there are also issues of contingency and sequentiality to be tackled. The thirteen colonies firmly integrated into a political union after the signing of the Constitution, and with the due exception of the Civil War, the integrity of the United States as a political entity has not been menaced. Historians and economists looking at the US record must consider how a peripheral, developing, coastal and weak nation with no banks transformed its economic structure and grew to become an industrialized and financial continental power by the late nineteenth century. The feat is even more surprising as we consider the international financial regimes under which the United States grew in the nineteenth century: the early American republic was a small, price-taking economy in a bimetallic regime. By adopting the Spanish silver dollar as its unit of account and the sustained acceptance of the public to fiduciary money in different forms, the US was able after all to participate with relative success in the gold standard regime by the last quarter of the nineteenth century.

In contrast, the European Union is an on-going political development trying to amplify what was originally an economic common zone. Yet in its short existence, and moreover since the euro crisis began, several countries have faced the question whether they want to remain in the currency union (Greece) or pertain to the political union at all (Great Britain). We must also take into account that European policymakers were not starting from scratch in their search for monetary unification: they faced a diversity of well-developed, national financial systems, each with its own institutions, practices and regulations. With regards to the international financial architecture, the euro venture has taken place in the post-Bretton Woods era of floating exchange rates and free flows of capital; as such, the euro, once seen as a potential rival to the dollar as international money, has acquired the characteristics of the Japanese yen and the Chinese yuan, that is, it has become an important currency but it lacks the capacity to substitute the US dollar as internationally-accepted means of payment.

Finally, a comparative history of the US and the European monetary unions should take into account the different elements of political economy at play in both cases. To a large extent, money and finance define the distribution of wealth and income, as they balance the power of both debtors and creditors. Moneyed interests in the US have been able to impose their will at times, as exemplified by the successful redemption of the greenbacks to gold and the soft adoption of the Dodd-Frank Act which has allowed Wall Street to go back to business as usual, as if the nationalization of financial losses had never happened. Yet, at other times, powerful financiers and speculators have been defeated by American politicians standing behind other goals, as demonstrated by the repudiation of the continentals and the passing of the Glass-Steagall Act, which separated investment banking from commercial banking.

Which are the vested interests and who are the actors in and behind the scenes of the European Union drama? Is power concentrated in the German taxpayers, the Merkel government, economic officers in Brussels, the European Central Bank in Frankfurt, the Basel banking lobby, the European Parliament, or the community of international investors and speculators? By now, it is rather obvious that Spanish, Italian and Greek constituencies lack any saying in the management of their countries’ debt, as austerity plans are imposed from the top, condemning their economies to stagnation which will reduce their labor costs and return to macroeconomic prudence. However, who belongs to this top? Are elected authorities of any use when the remedy requires hard, technocratic knowledge coming from the ECB or the International Monetary Fund? How much social dislocation and political disunion are necessary for the preservation of the euro? In my view, tackling some of these questions will enrich scholarly debate on monetary unions and help inform a wide, anxious audience, eager to make some sense on the world’s current economic woes.

References

Eichengreen, Barry. Golden Fetters: The Gold Standard and the Great Depression, 1919-39. Oxford: Oxford University Press, 1995.

Mihm, Stephen. A Nation of Counterfeiters. Capitalists, Con Men and the Making of the United States. Cambridge, MA: Harvard University Press, 2007.

McCoy, Drew R. The Elusive Republic. Political Economy in Jeffersonian America. Chapel Hill, NC: The University of North Carolina Press, 1980.

Rousseau, Peter. “Politics on the Road to the U. S. Monetary Union.” Vanderbilt University Department of Economics Working Papers, VUECON-13-00006, 2013.

Temin, Peter. Did Monetary Forces Cause the Great Depression? New York, NY: Norton, 1976.

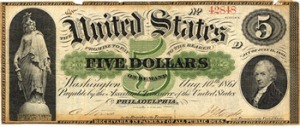

Guide to the Illustrations

Some of the images here were taken from the very illustrative Money in Motion exhibit of the Federal Reserve Bank of Philadelphia. The portrait of Alexander Hamilton was taken from here. The Van Court’s Counterfeit Detector image was taken from the “Faking It. Counterfeit Prevention and Detection” section of the “Capitalism by Gaslight. The Shadow Economies of 19th-Century America” exhibition by the Library Company of Philadelphia. The San Francisco Clearing House certificate was taken from the digital version of Carl Copping Penn, “The San Francisco Clearing House Certificates of 1907-1908”, Publications of the Academy of Pacific History, 1 (1), 1909, available here.

Reblogged this on Measuring Clio and commented:

A piece on the monetary unification in the United States.

Reblogueó esto en Metodología de la Investigación Cualitativa.

Pingback: Beware of Misleading Analogies: Monetary History Edition | The Past Speaks

To the post by Andrew Smith (Coventry University) in http://pastspeaks.com/2013/08/16/beware-of-misleading-analogies-monetary-history-edition/

Hi Andrew! Thanks for your comment! I cannot agree more on the limits of using comparisons between the monetary unification in the US and the European Union. My note at the end of the post is a first attempt to complicate what has become a common comparative exercise for both monetary theorists and monetary historians since the 1990s. Evidently, if we review the political history of the early and antebellum American republic, there are issues of citizenship, constituencies, enfranchisement, tensions between the federal and the state levels of government, territorial expansion, etc., that ought to be considered in a broader political economy study of monetary unification. Were the United States indeed born with the blessing of ”common culture and language” mentioned by Rousseau, or how did monetary arrangements changed with the purchase of the Louisiana and the Mexican war of 1848? What were the currencies used by slaves in the exercise of their very limited economic agency? What monies or means of payment are New York wholesalers or merchant bankers using in their long-distance transactions with Southern cotton planters and British importers? Who is the representative “economic agent” for which quantitative political scientists and public choice scholars could argue nineteenth-century American politicians legislated for? Evidently, the long history of granting voting rights to all citizens in the US in 1965 is a cautionary tale about politics. Yet I would like to assert that this process has a parallel in the emergence of a governance system and the creation of an European supranational order which is held more accountable to some -say, policymakers at the European Central Bank and the German Ministry of Finance- than to national citizens in Spain or Greece whose votes are ultimately marginalized in the adoption of public austerity plans and economic recession. Anyway, I’m glad to have read your post, and will keep in touch. Best regards!